A stop-loss order is a key trading tool designed to protect investors from significant losses by automatically closing a position when a predetermined price is reached. This article breaks down the concept, types, benefits, and how to use stop-loss orders effectively.

What is a Stop Loss Order?

A stop-loss order is an instruction given by an investor to their broker to sell a security if its price drops to a specific level, or conversely, to buy if the price rises to a predetermined amount. This automated process helps limit losses and can be used in various types of trading, including stocks, derivatives, and intraday trading.

Stop-loss orders are useful for both long and short positions. For long positions, a stop-loss order will sell the security if the price decreases, whereas for short positions, it will buy the security back to limit losses if the price increases.

Types of Stop Loss Orders

There are two main types of stop-loss orders:

- Limit Order

A stop-loss limit order allows the trader to specify the price at which they want to sell if the price moves unfavorably. If the security hits the stop price, the order becomes active but will only be executed at the set price or better. For example, a trader might set a stop-loss at Rs. 103 after shorting a stock at Rs. 100. If the price rises to Rs. 103, the order will execute at Rs. 103, limiting the loss. - Market Order

A stop-loss market order, on the other hand, will execute the order at the best available market price once the stop price is reached. For instance, if a stock is bought at Rs. 100 and the stop-loss is set at Rs. 104, the order will be executed at the next available market price once Rs. 104 is hit, regardless of any price fluctuations.

How Stop Loss Orders Work

The primary function of a stop-loss order is to control the potential losses in a trade. When a trader sets a stop-loss order, it acts as a safeguard, automatically closing the position once the price moves against them by a specified amount.

A stop-loss order to sell is placed when an investor wants to sell a security once its price falls below a certain threshold. A stop-loss order to buy is placed when the price is expected to increase, and the investor wants to limit potential losses if the price unexpectedly drops.

Purpose of a Stop Loss Order

The main goal of a stop-loss order is to reduce risk exposure by limiting potential losses. It also helps automate trading, so you don’t have to monitor your portfolio constantly. By setting a stop-loss order, you can have peace of mind knowing that if the market moves unfavorably, your position will be closed automatically.

Advantages of Stop Loss Orders

- Loss Minimization

Stop-loss orders help protect investors from significant losses, especially when market conditions are unpredictable. It ensures that you don’t hold onto losing positions for too long, potentially reducing your overall risk. - Automation

One of the biggest advantages of a stop-loss order is that it automates the selling or buying process. You don’t need to constantly monitor your trades, as the order will trigger automatically when the price reaches the specified level. - Risk and Reward Balance

A stop-loss order can help you maintain a balanced risk-to-reward ratio. By setting limits on how much you’re willing to lose, you can better manage your investments and avoid excessive risks. - Discipline in Trading

By using stop-loss orders, traders are less likely to let emotions influence their decisions. This helps maintain disciplined trading, encouraging investors to stick to their strategy without succumbing to fear or greed.

Disadvantages of Stop Loss Orders

- Market Fluctuations

A stop-loss order can be triggered during short-term price movements that are not reflective of the overall market trend. This can lead to unnecessary sales in volatile markets where prices fluctuate frequently. - Premature Exit

Sometimes, stop-loss orders may result in the premature closing of a trade that could have turned profitable if given more time. If the market experiences temporary dips, a stop-loss might force you out of a trade before it recovers. - Choosing the Right Price

Determining the right stop price can be difficult. Investors need to decide at what level they are willing to accept a loss, which often requires careful analysis of the market conditions and support levels.

How to Read Stop Loss Orders

To understand a stop-loss order, think of it as an essential order that sets a limit on potential losses. For example, if you buy a stock at Rs. 100 and the price begins to decline, you can set a stop-loss order at Rs. 90. If the price reaches Rs. 90, your position will automatically be closed to limit further losses.

It’s crucial to place your stop-loss order at an appropriate level, considering market support and resistance levels. This way, you can ensure your losses are minimized without exiting the trade too early.

Examples of Stop Loss Orders

- A trader purchases 100 shares of XYZ at $100, with a stop-loss order set at $90. As the stock price drops, the stop-loss order is triggered at $89.95, selling the shares at a slight loss. If the market continues to fall, the stop-loss order helped the trader avoid a much larger loss.

- Another trader buys 500 shares of ABC at $100. After a disappointing earnings report, the stock gaps down the next day, triggering a stop-loss order at $70. While this results in a large loss, the stop-loss order helped minimize the damage compared to the continued drop in price.

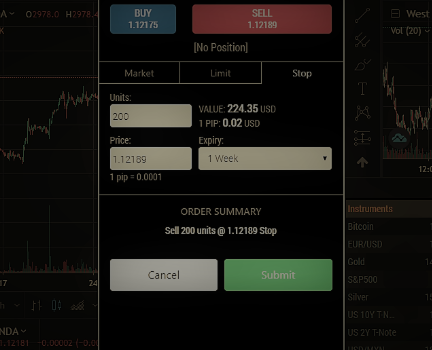

Procedure for Placing Stop Loss Orders

When placing a stop-loss order, consider both the price you’re willing to lose and the technical levels on the chart. For example, if you buy 1000 shares of a stock at Rs. 145 and the stock has good support at Rs. 135, you can set a stop-loss just below Rs. 135 to protect against a larger loss.

After identifying your stop price, decide whether to use a market stop-loss or a limit stop-loss. A market stop-loss will execute immediately at the next available price, while a limit stop-loss will only execute at the stop price or better.

Conclusion

Stop-loss orders are an essential risk management tool for traders and investors. They help limit losses and automate the process of closing positions, saving time and reducing emotional decisions. By carefully setting stop-loss levels, you can protect your investments while maintaining a balanced risk-to-reward ratio. Whether you’re new to trading or an experienced investor, understanding and utilizing stop-loss orders can significantly improve your trading strategy and overall performance.