Options trading can seem complex, but once you break it down, it’s easier to grasp. This blog post will introduce you to the fundamentals of options trading, including call and put options, and provide you with practical insights on how these work and how to use them for potential profit.

What is Options Trading?

In options trading, you are not directly buying or selling the underlying assets like stocks or commodities. Instead, you are trading the right to buy or sell these assets at a predetermined price within a specified period. This allows you to speculate on the price movements of assets without actually owning them.

There are two types of options: call options and put options. Understanding how they work and their respective strategies can significantly enhance your trading experience.

What is a Call Option?

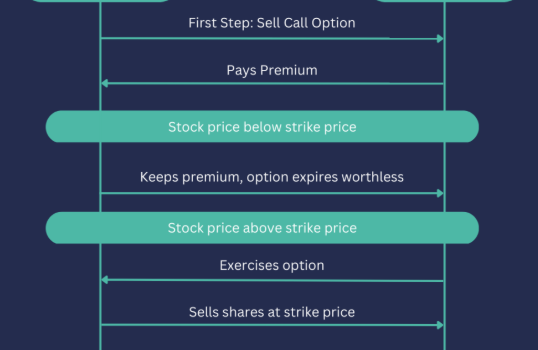

A call option is a contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a specific price (called the strike price) before a set expiration date. If the asset’s price rises above the strike price, the call option buyer can exercise the option and buy the asset at the lower strike price, potentially profiting from the difference.

Key Features of Call Options

- Right to Buy: You have the right to buy the underlying asset at the strike price.

- Premium: You must pay a premium to the seller for this right, which is the maximum amount you can lose.

- Expiration Date: The option expires at a specified time, after which it is no longer valid.

Factors Affecting Call Options

- Strike Price: A lower strike price makes the option more valuable, as it increases the likelihood of the asset price exceeding the strike price.

- Expiration Time: The longer the time until expiration, the more valuable the option may become, as it provides more opportunities for the asset price to move favorably.

- Volatility: A more volatile asset increases the potential for significant price movements, which can make the call option more valuable.

Example of a Call Option

Let’s say Microsoft shares are trading at $100 per share. You believe that the price will rise to $115 within the next month. You purchase a call option with a strike price of $115, and you pay a premium of $0.40 per share. If the price rises to $120, you can sell the option or exercise it, buying at $115 and selling at $120 for a profit.

How Do Call Options Work?

A call option works by giving the holder the ability to purchase shares at the strike price if the market price exceeds that level. The value of the option increases as the price of the underlying asset rises, and it expires worthless if the market price stays below the strike price.

Why Buy a Call Option?

Call options are ideal for traders who expect the price of the underlying asset to rise. If you are confident in a company’s growth potential, a call option allows you to profit from the increase in value without having to own the stock outright.

What are Put Options?

Put options work similarly to call options but with the opposite objective. A put option gives the buyer the right to sell an underlying asset at a predetermined price within a set time frame. If the asset’s price falls below the strike price, the buyer can sell the asset at the higher strike price, profiting from the difference.

Key Features of Put Options

- Right to Sell: You have the right to sell the underlying asset at the strike price.

- Premium: As with call options, you pay a premium to the seller for the right to sell the asset.

- Expiration Date: The option expires after a set time, similar to a call option.

Factors Affecting Put Options

- Underlying Asset Price: If the asset price falls below the strike price, the value of the put option increases.

- Interest Rates: Rising interest rates can lead to a decrease in the value of put options.

- Dividends: The payment of dividends can affect the value of put options, as it influences the underlying asset’s price.

Example of a Put Option

Suppose you buy a put option for a stock trading at $445, with a strike price of $425. If the stock price drops to $415, the option is “in the money,” and you can sell the stock at $425, even though it is currently worth less.

How Do Put Options Work?

Put options allow you to sell the underlying asset at the strike price. If the market price drops below the strike price, you can either exercise the option to sell the asset or sell the option itself for a profit.

Buying Put Options vs. Short Selling

While both strategies are used to profit from falling asset prices, buying puts has a key advantage: the maximum loss is limited to the premium paid, while short selling can expose you to unlimited risk. Additionally, short selling requires a margin account, which makes it more capital-intensive and risky compared to buying put options.

In The Money (ITM) vs. Out of the Money (OTM)

The decision between buying In The Money (ITM) or Out of the Money (OTM) options depends on your investment goals and risk tolerance. ITM options are more expensive but have a higher likelihood of profiting, as they are already profitable at the time of purchase. OTM options are cheaper but may expire worthless if the asset price does not move in your favor.

Conclusion

Understanding call and put options gives you a powerful tool for speculating on the price movements of assets. Whether you’re buying calls to profit from rising prices or purchasing puts to hedge against declines, options provide flexibility in your trading strategy. However, it’s essential to weigh the risks and rewards carefully before engaging in options trading, as the potential for both profit and loss is significant.

By mastering the basics of options trading, you can tailor your strategies to your risk profile and investment goals, ultimately becoming a more confident and informed trader.