If you’ve made financial mistakes in the past, it can feel overwhelming to think about improving your credit. Your credit score, often referred to as your “credit karma,” is shaped by your financial behavior over time—everything from paying bills on time to how much debt you’ve accumulated. If you find yourself struggling with poor credit, it’s not too late to change the direction of your financial future. With patience and smart financial habits, you can improve your credit score and start rebuilding your financial life.

What Is Credit Karma, and How Does It Affect You?

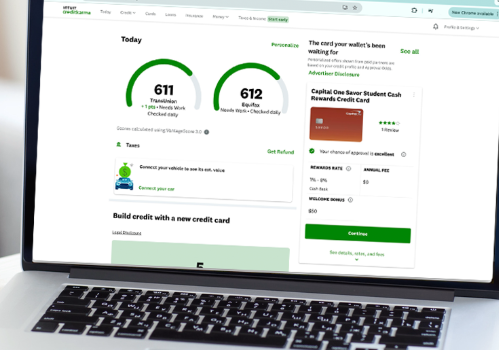

Credit karma is a term used to describe the impact of your past financial actions on your current credit situation. Negative behaviors like missing payments, borrowing more than you can handle, or co-signing loans for others can harm your credit. For instance, helping a friend with a car loan or cell phone contract may seem like a generous act, but if they fail to make their payments, it could damage your credit. Unfortunately, bad credit karma can catch up with you when you need a loan or mortgage, making it harder to secure good interest rates or approval.

Is It Possible to Fix Bad Credit Karma?

The good news is that, just like personal karma, you can improve your credit karma. By making better financial decisions and developing good habits, you can gradually raise your credit score and improve your financial standing. Although there’s no magic fix for bad credit, following a few key steps can help you get back on track.

Steps to Improve Your Credit Score

- Pay Your Bills on Time

Your payment history plays a significant role in your credit score. To show lenders you are reliable, make sure to pay your bills consistently and on time. Set reminders for due dates or use automatic payments to ensure you don’t miss any. A history of timely payments will boost your credit karma and increase your chances of getting approved for future loans. - Reduce Your Debt

Another critical factor in your credit score is your credit utilization ratio, which compares the amount of credit you’re using to your available credit limit. To improve your score, aim to keep your credit utilization below 30%. Focus on paying down existing debt and avoid adding to it. This will not only improve your credit score but also help you manage your finances better in the long term. - Balance Debt Repayment with Saving

It might sound counterintuitive, but saving money while paying off debt can actually help improve your credit. Building an emergency fund will prevent you from relying on credit when unexpected expenses arise. Having savings gives you a financial cushion that can keep you from falling back into debt, which will ultimately improve your credit score. - Stay Vigilant About Fraud

If you have unused credit accounts, don’t assume they’re safe just because they aren’t being actively used. Regularly monitor these accounts for any signs of fraudulent activity, as they can still negatively impact your credit if left unchecked. You can also request a free credit report annually to ensure that all the information on your report is accurate. - Be Strategic with New Credit Applications

Frequent credit applications can hurt your credit score, so avoid applying for credit unless absolutely necessary. When you do apply, opt for products that reflect well on your credit report, such as credit cards from established banks or credit unions, rather than high-interest options like payday loans or “buy now, pay later” services.

Focus on Progress, Not Perfection

When it comes to improving your credit, remember that small, consistent improvements add up over time. Avoid the temptation to rush or aim for perfection, as this can lead to frustration and setbacks. Focus on making gradual progress with your credit score by sticking to your financial goals and remaining disciplined.

Final Thoughts

Improving your credit karma is not an overnight process, but it’s absolutely achievable with the right mindset and actions. Whether you’re just starting out or working to repair past mistakes, taking steps to improve your credit score can lead to greater financial freedom and opportunities down the road. Stay committed to good financial habits, and in time, your credit score—and your financial future—will reflect your efforts.