Trading without the right tools can feel like navigating a stormy sea with no compass. For traders aiming to make confident decisions, technical indicators are the essential instruments guiding each move. These mathematical models help uncover patterns in price behavior, highlight optimal entry and exit points, and offer valuable insights into market momentum. Let’s explore the top 13 indicators that every serious trader should consider using.

Understanding Technical Indicators

Technical indicators are tools used to interpret financial data, mainly price and volume, to forecast future movements in the market. They can be grouped into two main types:

- Overlays: Displayed directly on the price chart, such as Moving Averages or Bollinger Bands.

- Oscillators: Positioned above or below the chart, like RSI or MACD, and used to identify overbought or oversold conditions.

Now, let’s dive into the indicators that can transform your trading approach.

1. On-Balance Volume (OBV)

OBV tracks trading volume to determine buying and selling pressure. When volume increases on up days, OBV rises, suggesting stronger demand. A declining OBV implies weakening interest and potential price drops. Traders often use OBV to validate trends or spot divergence.

2. Simple Moving Average (SMA)

The SMA calculates the average price of a security over a set period, smoothing out short-term fluctuations. It helps traders identify overarching trends and is often used to detect potential support or resistance levels.

3. Accumulation/Distribution Line (A/D Line)

This indicator combines price and volume to assess whether a stock is being accumulated or distributed. A rising line suggests buying pressure, while a falling line indicates selling. Divergences between the A/D line and price action can signal trend reversals.

4. Exponential Moving Average (EMA)

The EMA gives more weight to recent prices, reacting faster to changes than the SMA. It’s particularly useful for short-term traders looking to confirm shifts in momentum more quickly.

5. Average Directional Index (ADX)

ADX evaluates the strength of a trend. Readings above 40 indicate a strong trend, while those below 20 suggest sideways movement. It can be combined with other indicators to determine the direction and strength of price action.

6. Stochastic Oscillator

This momentum indicator compares the closing price to a range of prices over a set period. Readings above 80 signal overbought conditions; below 20 suggest oversold. It’s a favorite for timing reversals in both uptrends and downtrends.

7. Aroon Indicator

The Aroon Indicator measures how long it has been since the price reached a high or low. A crossover between the Aroon Up and Aroon Down lines may indicate a new trend forming.

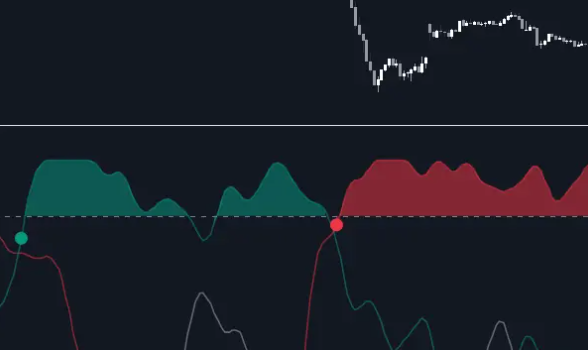

8. Moving Average Convergence Divergence (MACD)

MACD helps identify changes in momentum and trend direction. The MACD line crossing above the signal line can be a buy signal, and vice versa for sell signals. Traders also use MACD histograms to visualize strength.

9. Relative Strength Index (RSI)

RSI assesses the speed and change of price movements on a scale from 0 to 100. It helps identify overbought (above 70) or oversold (below 30) conditions. Divergences between RSI and price trends often signal weakening momentum.

10. Fibonacci Retracement

Fibonacci levels identify potential areas where a stock may reverse direction. These are especially helpful in pinpointing support or resistance zones after significant price movements.

11. Bollinger Bands

This indicator consists of three lines: a moving average in the center and two bands above and below. Prices touching the upper band may indicate overbought conditions, while the lower band suggests oversold scenarios.

12. Parabolic SAR

This tool provides visual cues for the direction of an asset’s trend. When dots appear below the price, it signals an uptrend. Dots above the price suggest a downtrend. It’s commonly used to set stop-loss levels.

13. Ichimoku Cloud

More complex than others, this all-in-one indicator delivers trend direction, support/resistance levels, and momentum. It’s useful for spotting potential reversals or areas of consolidation.

Why Use Technical Indicators?

Using these tools gives traders an edge by offering:

- Clear Entry/Exit Signals: Reduce guesswork with defined trade timing.

- Trend Identification: Spot trends early to stay ahead of the market.

- Risk Management: Set stop-losses and manage risk based on data, not emotions.

- Enhanced Confidence: Understand market behavior and avoid impulsive decisions.

Things to Keep in Mind

Before relying on any indicator, it’s crucial to:

- Understand how the indicator works and its ideal market conditions.

- Avoid overcrowding your charts with too many tools.

- Test strategies with historical data or a demo account.

- Recognize that no tool is infallible—combine with sound analysis and risk control.

Is Technical Analysis Trustworthy?

While technical analysis isn’t a crystal ball, it’s a powerful method to interpret market psychology and trends. When combined with discipline and a well-structured strategy, it becomes a key part of any successful trading approach.

Final Thoughts

A strong trading toolkit isn’t built on guesswork—it’s built on strategy, analysis, and the right indicators. Whether you’re new to trading or refining your approach, these 13 technical indicators offer a structured pathway to smarter decisions and greater confidence in the markets. Choose the ones that suit your style, test them thoroughly, and let data guide your journey.