Managing your finances can feel like playing in the Super Bowl – the stakes are high, and winning takes strategy, effort, and constant practice. Whether you’re already financially savvy or just starting out, creating a solid financial plan is key to scoring big. You don’t have to be a football fan to apply these winning strategies to your personal finances. Here’s how you can craft a game plan to help you reach your financial goals.

Your Budget Is Your Playbook

In football, teams rely on their playbook to navigate the game and stick to their strategy. Your budget serves as your personal financial playbook. It’s a plan that helps you manage your money effectively and ensures you stay on track to reach your financial goals. Your playbook should include:

- All sources of income

- Regular and irregular expenses

- Debt repayments

- Short-term and long-term savings goals

Don’t forget to build an emergency fund into your playbook. Like a football interception, unexpected expenses can derail your finances. Having money set aside for emergencies will help you get back on track without throwing in the towel.

Building a Strong Support Team

In football, the head coach can’t do everything alone. They rely on assistant coaches to provide expertise in various areas of the game. Similarly, you should surround yourself with professionals who can guide you in managing your money. Here are some experts to consider:

- Financial Institutions: Look for a bank or credit union that offers products and services that suit your needs.

- Credit Counselors: These experts can help you create a realistic budget, offer debt repayment solutions, and teach you how to manage credit wisely.

- Insurance Advisors: They can help you choose the right insurance policies for your circumstances.

- Legal Professionals: A lawyer or notary can assist with important legal matters like wills and estate planning.

- Certified Financial Planners: These advisors can help you craft long-term investment strategies and plan for your financial future.

Protect Your Financial Health with Savings

In football, getting sacked can stop the momentum of the game. Similarly, a financial crisis can stop your plans in their tracks. That’s why saving is essential. Building up savings gives you the security you need in case of an unexpected setback. During the pandemic, many people relied on their savings to get by, and it’s a valuable lesson to keep in mind.

Having savings also opens up opportunities for you. Whether it’s going back to school, starting a business, or retiring early, having money set aside will make it easier to seize these opportunities and reach your financial end zone.

Finding the Funds to Save

Where can you find the money to build your savings? The answer lies in being mindful of your spending habits. Look for areas where you can cut back, such as dining out less or canceling subscriptions you don’t use. By reducing unnecessary expenses, you can redirect that money into your savings fund.

Work as a Team with Your Partner

Managing finances is a team effort, especially if you have a spouse or partner. Having regular discussions about your financial goals and reviewing your budget together will keep both of you on the same page. You can even assign roles based on each person’s strengths. One might handle the day-to-day budgeting, while the other focuses on long-term investments.

A key player in your team is the “tight end” of your finances. This person helps ensure you don’t overspend and keeps the budget on track. By working together and supporting each other, you can avoid financial penalties and stay focused on your goals.

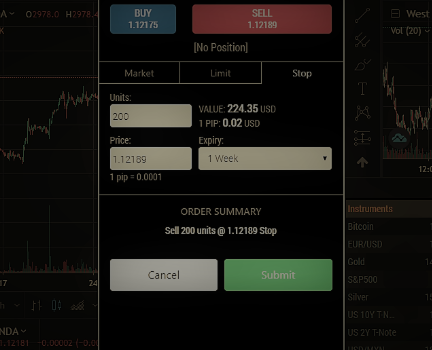

Don’t Wait for the Big Play – Plan for Your Financial Goals

Achieving your financial goals is more than just waiting for the right opportunity. Much like a football game, it’s about playing the long game and taking action to achieve the financial success you want. Remember, the competition is only against yourself – there’s no deadline, and it’s never too late to start.

Keep track of your spending, avoid relying on credit cards to make ends meet, and make informed decisions that align with your financial goals. And if you ever need help, don’t hesitate to reach out to the experts who can help guide you.

By creating a solid game plan, working as a team, and sticking to your financial goals, you can score your own financial touchdown and set yourself up for a winning future.